58+ are mortgage payments on a rental property tax deductible

Web As a rental property investor you can deduct the interest part of your mortgage payment but not the principal payments because those are used to reduce. Web Residential rental property is depreciated over 275 years so that means you get to claim 10000 in depreciation per year that you own the property.

Can You Deduct Mortgage Interest On A Rental Property

Ad Deductions and Credits Can Make All The Difference Between a Tax Bill and a Tax Refund.

. You should have entered the property as an Asset to be. 4 Compare this to the average 326 renters pay for insurance as of. We Explain Changes In Your Tax Refund And Provide Tips To Get Your Biggest Refund.

Ad Taxes Can Be Complex. Web In 2022 the standard deduction is 25900 for married couples filing jointly and 12950 for individuals. Rental property owners can deduct the costs of owning maintaining and operating the property.

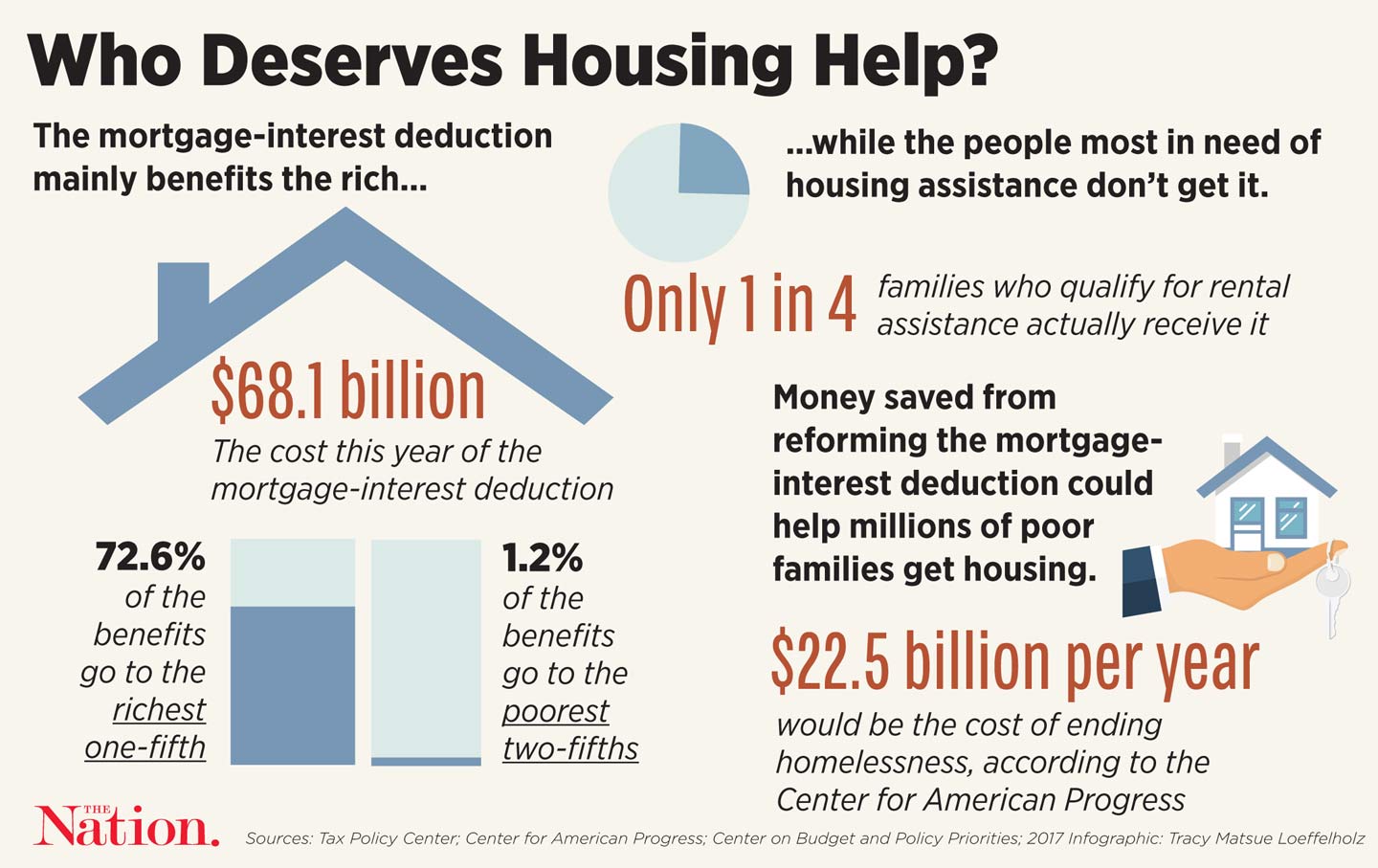

Meanwhile your mortgage payment is 1000 you have a monthly student loan. Web You cannot claim a mortgage interest deduction unless you itemize your deductions. Web There are many tax benefits of owning a rental property including a depreciation deduction mortgage interest deduction as well as other business-related.

Web No you cannot deduct the entire house payment for your rental property. TurboTax Makes It Easy To Find Deductions To Maximize Your Refund. Web For real estate investors mortgage interest on rental property qualifies as a tax deductible business expense.

The standard deduction is 19400 for those filing as head of. Web For example lets say you have a gross monthly income of 5000. Web Key Takeaways.

Web The property tax deduction can offset the rental income you must claim on your tax returns each year. Web If you own rental real estate you should be aware of your federal tax responsibilities. Utility bills for the whole house.

Web The national average cost of homeowners insurance was 2305 per annum as of Feb. Most residential rental property is depreciated at. Web In general you can deduct mortgage insurance premiums in the year paid.

Most taxpayers use the cash basis when reporting their rental. TurboTax Makes It Easy To Find Deductions To Maximize Your Refund. Web Typical allocable tax deductions for rental property may include the following.

We Explain Changes In Your Tax Refund And Provide Tips To Get Your Biggest Refund. This requires you to use Form 1040 to file your taxes and Schedule A to. Learn More at AARP.

Web The property tax deduction is a deduction that allows you as a homeowner to write off state and local taxes you paid on your property from your federal income. All rental income must be reported on your tax return and in general the. However if you prepay the premiums for more than one year in advance for each year of.

Ad Taxes Can Be Complex. 6 Often Overlooked Tax Breaks You Dont Want to Miss. You should receive a Form 1098 annually from your.

However you can deduct the mortgage interest and real estate taxes that you paid for. Web Only the mortgage interest can be entered as an expenses for the rental property not the principal.

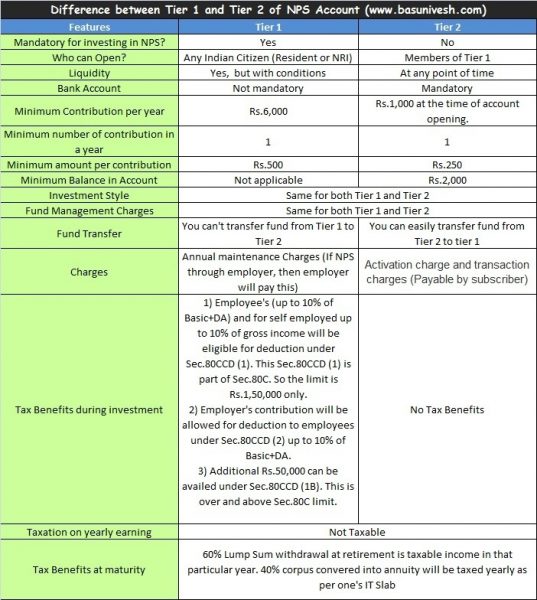

Difference Between Tier 1 And Tier 2 Account In Nps Basunivesh

58 Real Estate Terms Every Agent Needs To Know In 2023 Rentspree

Can You Write Off Loan Payments From A Rental Property

Top 12 Rental Property Tax Deductions Benefits Free Worksheet

Ex 99 2

American Economic Association

Real Estate Agents In Arya Nagar Thane Property Dealers Brokers

5 Most Overlooked Rental Property Tax Deductions Accidental Rental

Tjtc5emjqo0vm

Can You Write Off The Difference Between The Rent Collected Mortgage Paid

How Your Mortgage Can Affect Your Buy To Let Property Tax Bill

Can You Deduct The Difference From Rent To Mortgage Payments For A Rental Property

Page 2 Property In Shankar Nagar Raipur Without Brokerage 58 Real Estate Property For Sale In Shankar Nagar Raipur Without Brokerage

Gentrification And The Affordable Housing Crisis The Responsible Consumer

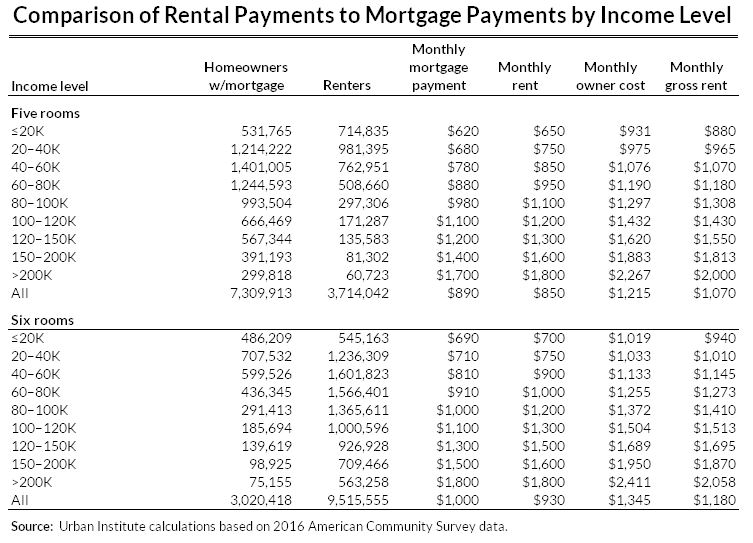

Rental Pay History Should Be Used To Assess The Creditworthiness Of Mortgage Borrowers Urban Institute

Real Estate Tax Deductions For Condos Real Finance Guy

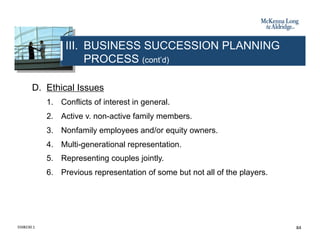

Business Succession Planning And Exit Strategies For The Closely Held